The role of the Polk Tax Collector is integral to the functioning of Polk County, ensuring the efficient collection of taxes and fees, and administering various services to residents. The office not only handles property taxes but also aids in vehicle registration, driver’s licenses, and various other governmental functions. Understanding the comprehensive operations of this office can provide valuable insights into how local governance affects daily life and community resources.

For many residents, the Polk Tax Collector’s office is a key touchpoint for managing essential civic duties. From paying property taxes to renewing vehicle registrations, the office ensures these processes are streamlined and accessible. This article delves into the various functions of the Polk Tax Collector, offering a detailed look at its operations, services, and the impact on local residents. By exploring the diverse roles and responsibilities of the office, we aim to empower residents with knowledge that can facilitate smoother interactions with governmental processes.

In an era where digital transformation is reshaping the way governmental services are delivered, the Polk Tax Collector stands at the forefront of innovation. The office is continually working towards enhancing service delivery through digital platforms, making processes more efficient and resident-friendly. This article will explore these advancements, highlighting how the office adapts to changing technological landscapes while maintaining robust service delivery standards.

Read also:Ultimate Guide How To Access Police Reports In San Antonio Tx

Table of Contents

- History and Evolution of the Polk Tax Collector's Office

- What Are the Key Services Offered by the Polk Tax Collector?

- Understanding Property Tax Collection in Polk County

- Vehicle Registration and Title Services

- How Does the Polk Tax Collector Handle Driver’s Licenses?

- Business Tax Receipt and Local Business Tax

- Hunting and Fishing Licenses: What You Need to Know

- Impact on the Community: How Does the Polk Tax Collector Influence Local Life?

- Digital Transformation: Modernizing the Polk Tax Collector Services

- Customer Service Excellence in the Polk Tax Collector's Office

- Financial Management and Transparency

- Community Engagement and Outreach Initiatives

- Frequently Asked Questions about the Polk Tax Collector

- Conclusion: The Future of the Polk Tax Collector's Office

History and Evolution of the Polk Tax Collector's Office

The Polk Tax Collector's office has a rich history that reflects the growth and development of Polk County itself. Established to manage the collection of taxes and other fees, the office has evolved significantly over the years. Initially, the primary function was to collect property taxes, but with time, the scope of services expanded to include vehicle registrations, driver’s licenses, and other essential civic services.

Over the decades, the office has adapted to changes in legislation, technology, and community needs. The evolution of the Polk Tax Collector's office is marked by a continuous effort to improve service delivery and increase accessibility for residents. This has involved the implementation of new technologies and processes to streamline operations and enhance customer satisfaction.

What Are the Key Services Offered by the Polk Tax Collector?

The Polk Tax Collector provides a wide range of services that are crucial for residents and businesses within the county. These services are designed to facilitate the efficient and effective management of civic duties, ensuring compliance with local and state regulations.

Property Tax Collection

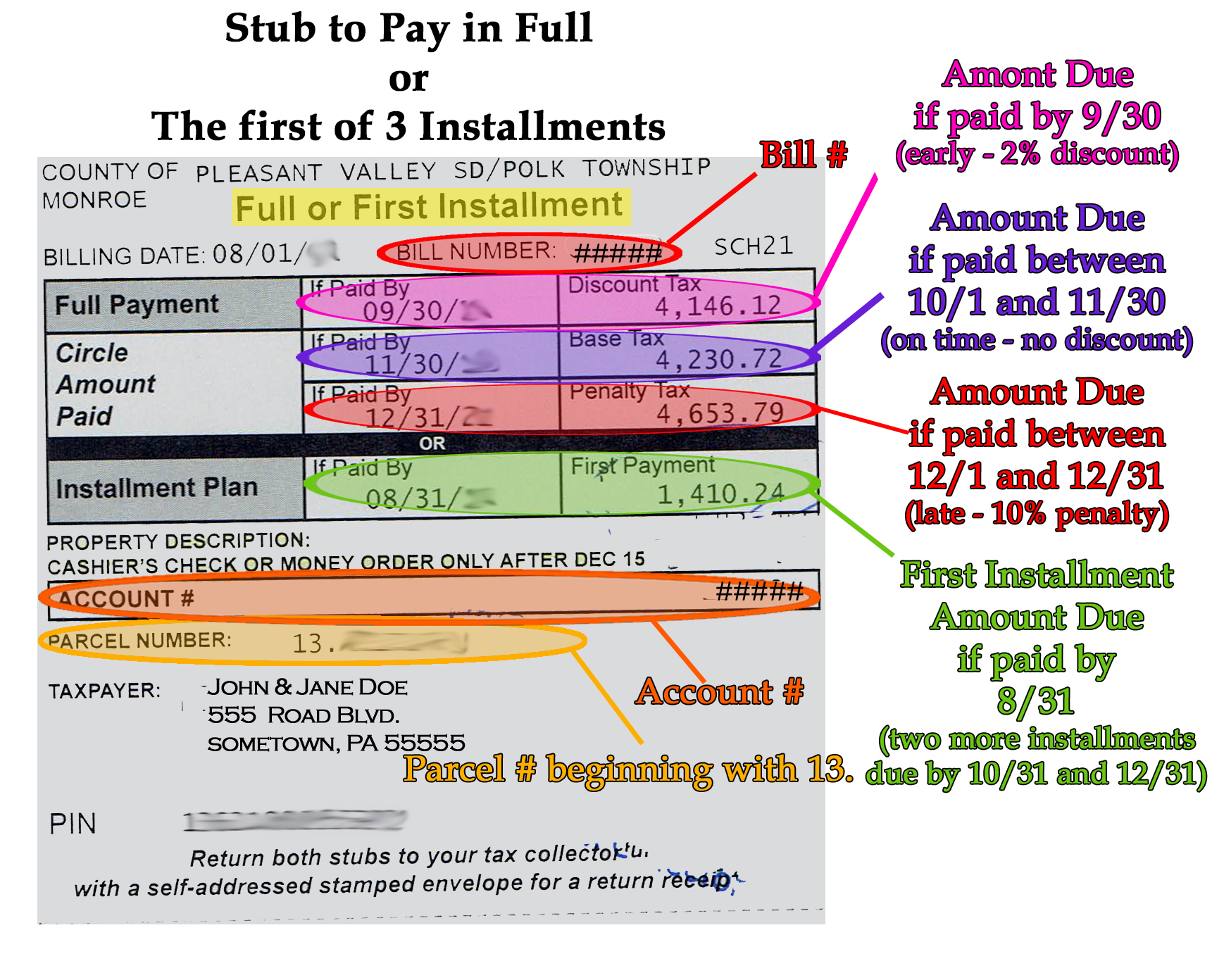

The collection of property taxes is one of the primary functions of the Polk Tax Collector. This involves assessing property values, calculating tax liabilities, and ensuring timely payments. The office also handles delinquent taxes and offers payment plans to assist residents who are experiencing financial difficulties.

Vehicle Services

Vehicle registration and title services are another key area of responsibility for the Polk Tax Collector. This includes the issuance and renewal of vehicle registrations, processing title transfers, and managing specialty license plates. The office works closely with the Department of Motor Vehicles to ensure compliance with state regulations.

Driver’s License Services

The Polk Tax Collector's office is responsible for issuing and renewing driver’s licenses and identification cards. This includes administering written and road tests, processing changes of address, and managing suspensions and reinstatements. The office ensures that all driver’s license services are conducted in accordance with state laws and regulations.

Read also:Philanthropy Gala Red Carpet A Night Of Glamour And Giving

Business and Occupational Licenses

For businesses operating within Polk County, the tax collector's office provides business tax receipt services. This involves issuing and renewing business licenses, ensuring compliance with local ordinances, and providing information on regulatory requirements for different types of businesses.

Understanding Property Tax Collection in Polk County

Property taxes are a significant source of revenue for local governments, funding essential services such as education, public safety, and infrastructure development. In Polk County, the tax collector’s office plays a critical role in managing the property tax process, ensuring that property owners meet their tax obligations.

The property tax process begins with the assessment of property values by the Property Appraiser's Office. Once values are determined, the Polk Tax Collector calculates the tax due based on the millage rates set by various taxing authorities. Property owners receive annual tax notices, typically in November, with payment due by March 31 of the following year.

Vehicle Registration and Title Services

Maintaining current vehicle registration is a legal requirement for all vehicle owners in Polk County. The Polk Tax Collector's office provides convenient options for registering and renewing vehicle registrations, including online services, mail-in renewals, and in-person transactions at local branch offices.

Title services are also available for vehicle owners needing to transfer ownership or obtain a duplicate title. The Polk Tax Collector ensures that all transactions are conducted in compliance with state regulations, providing guidance and assistance to residents throughout the process.

How Does the Polk Tax Collector Handle Driver’s Licenses?

The issuance and renewal of driver’s licenses are essential services provided by the Polk Tax Collector. The office ensures that all residents have access to these services, offering written and road tests, vision screenings, and document processing. The goal is to maintain road safety while providing efficient and accessible services.

Driver’s license services are available by appointment, reducing wait times and ensuring a smooth experience for residents. The Polk Tax Collector also offers online services for renewing licenses and updating personal information, making it easier for residents to manage their driver’s license needs.

Business Tax Receipt and Local Business Tax

For businesses operating in Polk County, obtaining a business tax receipt is a legal requirement. The Polk Tax Collector's office manages the issuance and renewal of these receipts, ensuring compliance with local ordinances. Businesses must renew their tax receipts annually, with the office providing guidance on the application process and regulatory requirements.

The local business tax is an important source of revenue for the county, funding essential services and infrastructure. The Polk Tax Collector works closely with the local government to ensure that all businesses are properly licensed and compliant with relevant regulations.

Hunting and Fishing Licenses: What You Need to Know

The Polk Tax Collector’s office offers hunting and fishing licenses, providing residents with the opportunity to enjoy outdoor recreational activities while ensuring compliance with state wildlife regulations. Licenses can be purchased online, through the mail, or in person at local branch offices.

Hunting and fishing licenses are available for residents and non-residents alike, with options for annual, multi-year, and lifetime licenses. The Polk Tax Collector provides information on the various types of licenses available, as well as any additional permits required for specific activities.

Impact on the Community: How Does the Polk Tax Collector Influence Local Life?

The Polk Tax Collector has a significant impact on the local community, serving as a vital link between residents and government services. By managing the collection of taxes and fees, the office ensures that essential services such as education, public safety, and infrastructure are adequately funded.

The office also plays a key role in supporting local businesses by providing business tax receipt services, helping to create a favorable environment for economic growth and development. Through its various services, the Polk Tax Collector contributes to the overall quality of life in Polk County, making it a better place to live and work.

Digital Transformation: Modernizing the Polk Tax Collector Services

In recent years, the Polk Tax Collector has embraced digital transformation to enhance service delivery and improve accessibility for residents. By implementing new technologies and processes, the office has made it easier for residents to manage their tax obligations and access essential services.

Online services have become a key component of the Polk Tax Collector’s operations, providing residents with the convenience of managing their civic duties from the comfort of their homes. This includes options for paying property taxes, renewing vehicle registrations, and updating driver’s license information. The office continues to explore new ways to leverage technology to improve service delivery and meet the evolving needs of the community.

Customer Service Excellence in the Polk Tax Collector's Office

The Polk Tax Collector is committed to providing excellent customer service, ensuring that all residents have a positive experience when interacting with the office. This commitment is reflected in the office’s dedication to continuous improvement, with staff regularly receiving training to enhance their skills and knowledge.

Customer service is a top priority for the Polk Tax Collector, with efforts focused on reducing wait times, improving communication, and providing accurate and timely information to residents. The office also seeks feedback from residents to identify areas for improvement and ensure that services meet the needs and expectations of the community.

Financial Management and Transparency

Effective financial management is crucial for the Polk Tax Collector, ensuring that all funds collected are properly accounted for and used to support essential services. The office is committed to transparency and accountability, providing detailed reports on revenue collection and expenditure to maintain public trust.

The Polk Tax Collector works closely with local government and other stakeholders to ensure that financial management practices are in line with best practices and regulatory requirements. This includes regular audits and reviews to identify any areas for improvement and ensure that resources are used efficiently and effectively.

Community Engagement and Outreach Initiatives

The Polk Tax Collector is actively engaged in the community, working to build strong relationships with residents and local organizations. Through outreach initiatives, the office seeks to educate residents on their tax obligations and the services available to them, promoting compliance and fostering a sense of civic responsibility.

The office also collaborates with local schools, businesses, and community groups to support various programs and initiatives. This includes participating in community events, providing educational resources, and offering support for local economic development efforts.

Frequently Asked Questions about the Polk Tax Collector

- What are the office hours of the Polk Tax Collector?

- How can I pay my property taxes?

- What documents do I need to renew my driver’s license?

- Can I renew my vehicle registration online?

- How can I obtain a business tax receipt?

- Where can I purchase a hunting or fishing license?

The Polk Tax Collector's office is open Monday through Friday, from 8:30 AM to 5:00 PM. Some branch offices may have extended hours or offer services by appointment.

Property taxes can be paid online, by mail, or in person at any Polk Tax Collector branch office. Online payments can be made using a credit card or electronic check.

To renew your driver’s license, you will need to provide proof of identity, Social Security number, and residential address. Acceptable documents include a passport, Social Security card, and utility bill.

Yes, you can renew your vehicle registration online through the Polk Tax Collector's website. You will need your vehicle registration renewal notice and a valid credit card for payment.

Business tax receipts can be obtained by submitting an application to the Polk Tax Collector's office. You will need to provide information about your business, including its name, address, and type of operation.

Hunting and fishing licenses can be purchased online, by mail, or in person at any Polk Tax Collector branch office. You will need to provide proof of residency and a valid form of identification.

Conclusion: The Future of the Polk Tax Collector's Office

The Polk Tax Collector's office plays a vital role in the community, providing essential services that support residents and businesses in Polk County. The office is committed to continuous improvement, embracing digital transformation to enhance service delivery and improve accessibility for all residents.

Looking to the future, the Polk Tax Collector will continue to explore new ways to leverage technology and innovation to meet the evolving needs of the community. By building strong relationships with residents and local organizations, the office will remain a trusted partner in supporting the growth and development of Polk County.

Through its dedication to customer service, financial transparency, and community engagement, the Polk Tax Collector is poised to continue making a positive impact on the lives of residents and the overall quality of life in Polk County.